Income Tax Section 33

Inter american center of tax administrationsciat organisation for economic co operation and developmentoecd international bureau of fiscal documentationibfd asian development bankadb world bank.

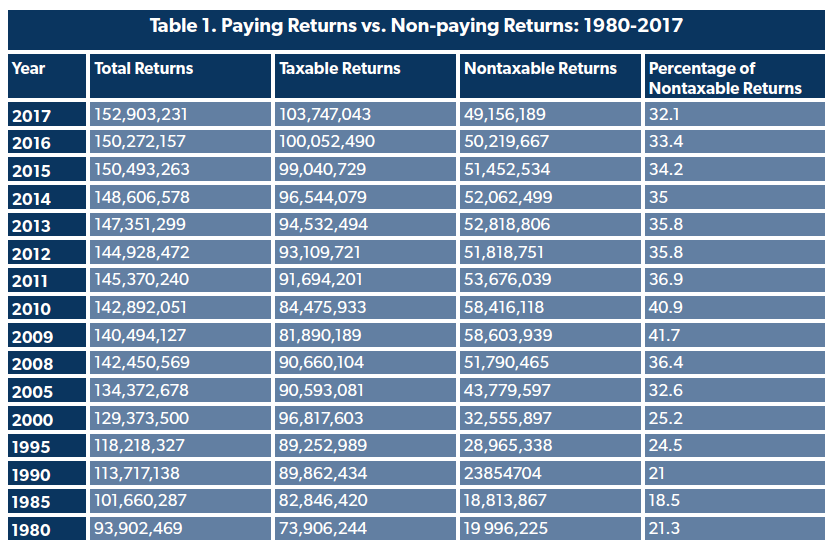

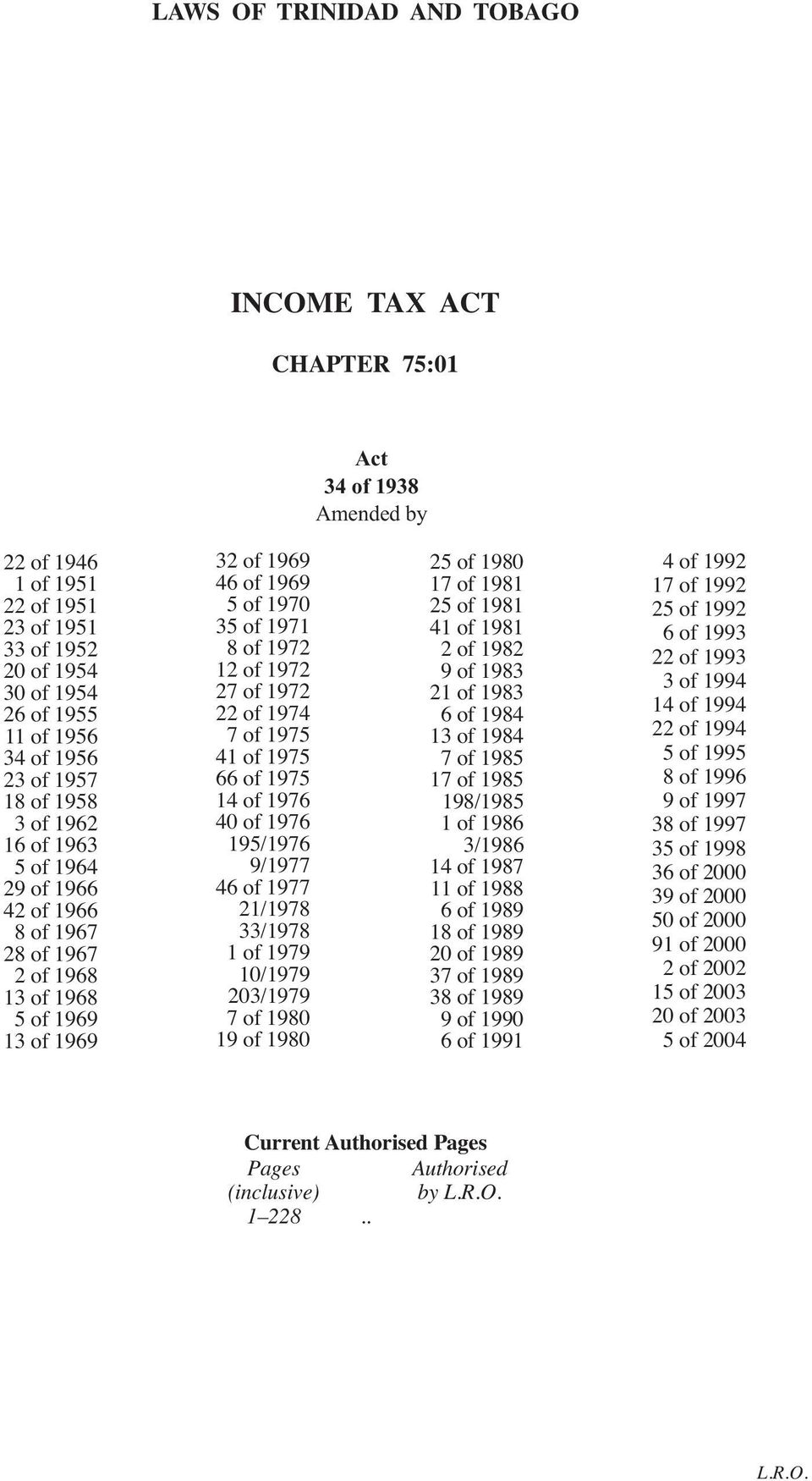

Income tax section 33. The original article 33 only allowed the tax authorities to make an upward adjustment to the taxable profit of an enterprise in order to tax a profit that should have accrued to the enterprise on an arms length basis. A interest expense on money borrowed. Scope of the total income. Income deemed to accrue or arise in bangladesh.

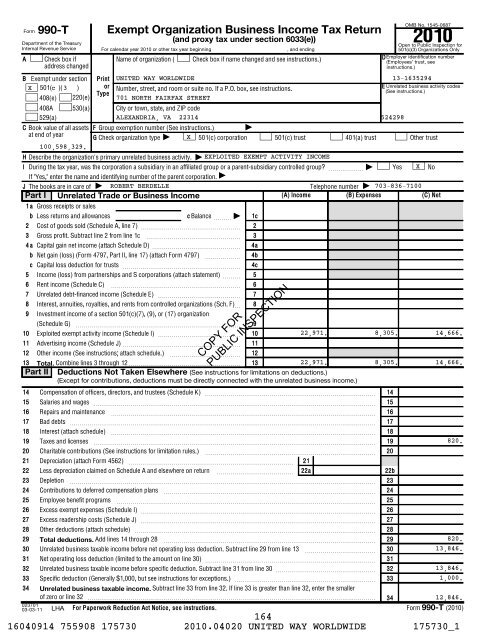

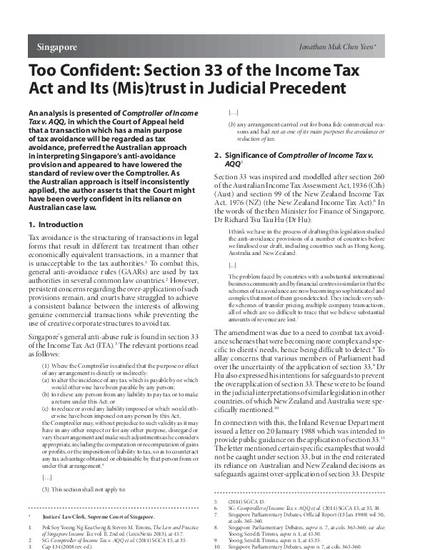

Charge of minimum tax. Tax administration diagnostic assessment tooltadat association of tax authorities in islamic countriesataic. The scheme and purpose approach is as follows. In essence the comptroller disregarded the service arrangement in place between xco and yco and imposed income tax on gcl in his personal capacity as though the previous employment arrangement.

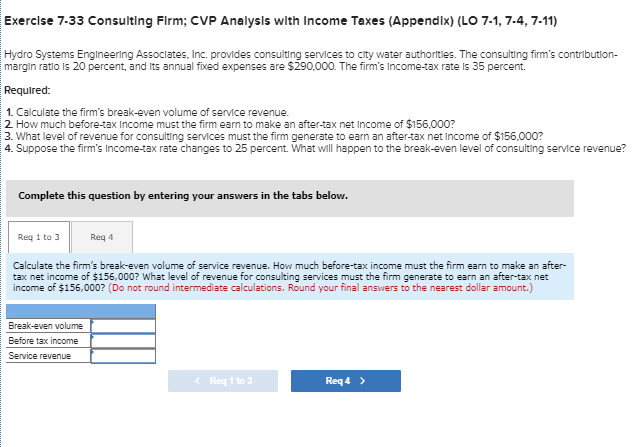

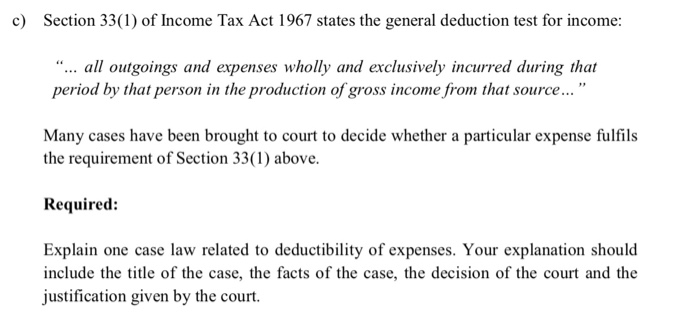

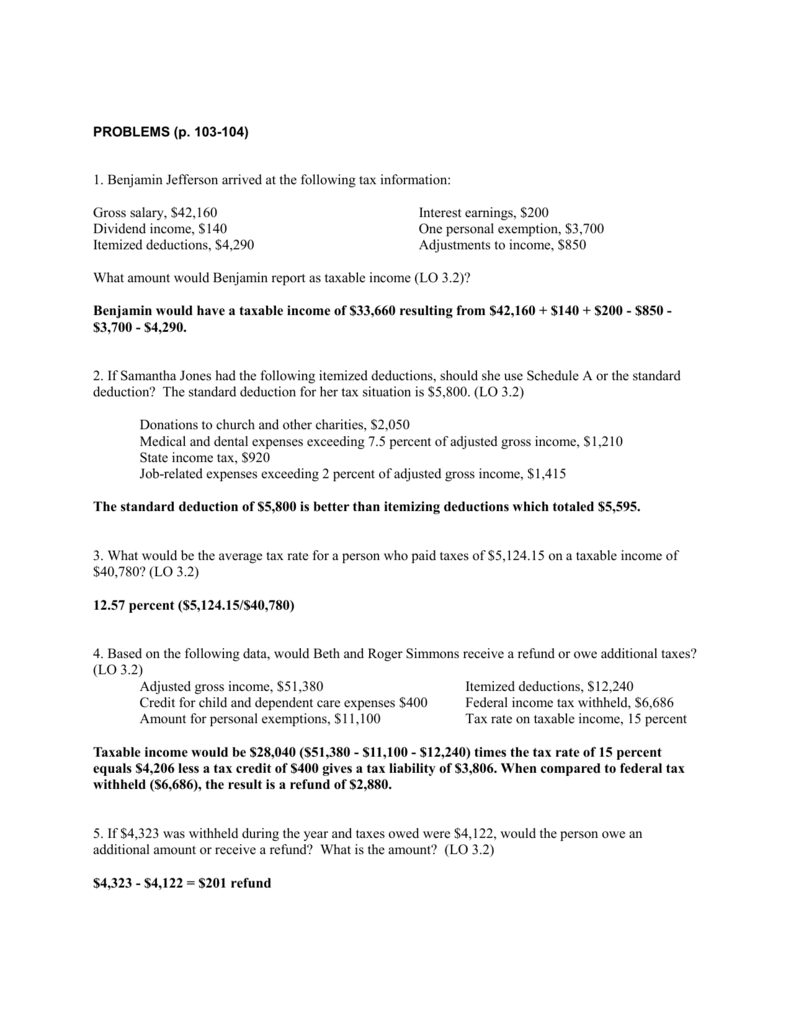

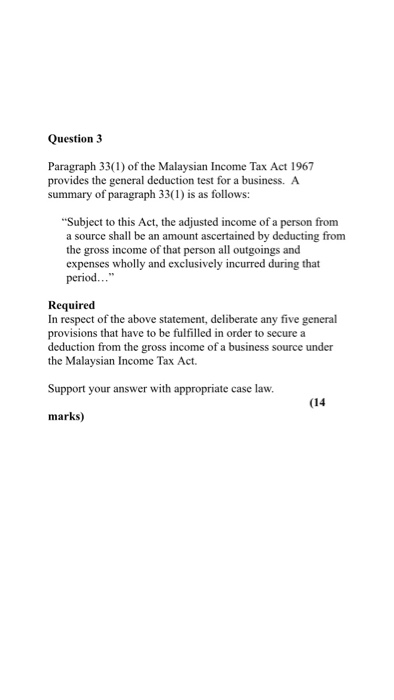

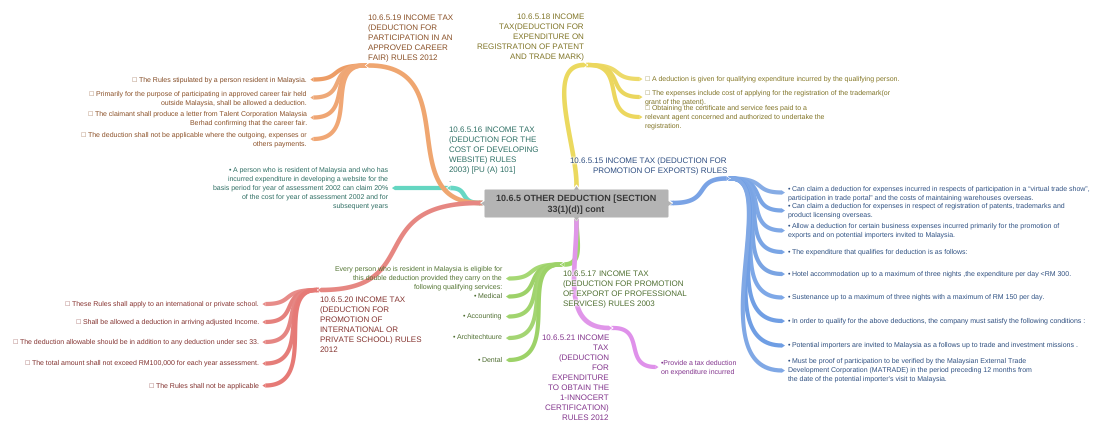

By tan thai soon. Section 33 1 the adjusted income of a person from a source for the basis period by deducting from the gross income of that person from that source for that period all out goings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source including. Charge of excess profit tax. And if so ii consider whether the taxpayer may avail himself of the statutory exception.

Interpretation of section 33. Paragraph d5id of this section applies to any original consolidated federal income tax return due without extensions after june 14 2007. 1 in respect of depreciation of i buildings machinery plant or furniture being tangible assetsii know how patents copyrights trade marks licences franchises or any other business or commercial rights of similar nature being intangible assets acquired on or after the 1st day of april 1998owned wholly or partly by the assessee and used for the purposes of. See eg 11502 33 and 11502 33t as contained in the 26 cfr part 1 edition revised as of april 1 1994.

Anti avoidance provision under section 33 of the income tax act the act to assess the income derived by xco in the name of gcl. 13a in respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in respect of the previous year in which the ship was acquired or the machinery or plant.